OUR VILLAGE

“Nectar Factor Foundation” a registered trust working on ‘Stress free Blissful Life’ through a Holistic approach.

The principle objective of Nectar Factor Foundation is to educate & heal Mental Health, Life Skills “Blissful Life: – Mental, Physical, Financial, Social and Spiritual dimensions of life”.

To promote ‘Stress Free’ Blissful life and successful life for all with the help of all required services and kinds.

Nectar Factor Foundation is registered under Indian Trust Act 1882, section 60, registration No. 998.

Nectar Factor Foundation possess registration of 80G (5) (VI) – CIT (Exemption), DELHI/80G/2018-19/A/10188 and 12AA CIT (EXEMPTION), DELHI/12AA/2018-19/A/10215 certificates under Income Tax Act 1961.

Our planning for Blissful society

To establish a world class ‘NECTAR FACTOR VILLAGE’ routed on Indian ancient values of life to attain ultimate ‘BLISSFULNESS’

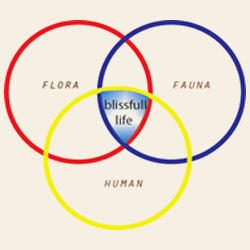

Close to nature, Nectar Factor Village will be a unique combination among Human + Flora (Vegetation) + Fauna (Animal) the ultimate connection with nature and will be used as a tool in healing. The residence is designed with nature friendly material and design. Back to Basics is the theme of village.

The main cause of today’s misery in human life is absence of balance among these three dimensions of nature.

We are establishing a village to heal the Emotional, Mental and Physical wounds of today’s Zombies who are only attached with gadgets and become the apathies combination of ‘Man & Machine’.

The village will take care Emotional, Mental and physical imbalance in our guests. Long term solutions which will bring permanent remedy to solve the misery of life…

Our own produced cultivation and milk products will be consumed in village and there after supplied to visitors if required… the guest will serve in the field as well cattle area to touch the ‘Mother Nature’ as well heal self…as per Ayurveda this is one of the best remedy for mental disorder.

We will provide the complete permanent solution as far as Mental & Physical Health concern.

Needless to mention that maximum numbers of manpower will be gathering from local resources and trained for the next level…

We will be conducting not only one to one counselling, hand holding, coaching and mentoring as well group discussions, training and workshops for group visitors also.

Visitors will be staying in natural environment with qualified guide who will take care of their needs…

We will be conducting short term as well long term workshops and trainings as per requirements of guest.

The young generation who is not exposed to actual natural Indian cultural, will have exposure to our roots which definitely will bring them back to the basics.

We will be providing state of art complete ‘AYUSH’ remedies which are based on Mother Nature and brings the permanent solutions.

24 hours qualified resident staff to take care daily needs will be a handy comfort for the visitors.

We are not only developing state of art facilities for human but even the domestic as well wild life animals will be benefited with our Animal hospital and orphanage.

We will be organically cultivating our daily need of food as well herbs for treatment too.

Last but not the least, expert visitors in their domain will be sharing their experience and guide the local youths who will not be able to have this kind of mature and experienced direction otherwise. For visitors it will be “Back to the society” service.

NECTAR FACTOR VILLAGE

- Residential Units/cottages

- Meditation dome

- Therapy centres

- Conference Halls

- Counselling centre

- Library

- Instrumental Music room

- Sports arena

- Cultivation area

- Dairy and Animal area

- Product outlet

- Bio Gas Plant

- Organic fertilizers plant

- Solar plant

- Dairy plant

- Kitchen

- Academic & vocational school for local children. The subject expert guest will give community – service

- Helipad

Nectar Factor Foundation is registered under Indian Trust Act 1882, section 60, registration No. 998.

Nectar Factor Foundation possess registration of 80G (5) (VI) – CIT (Exemption), DELHI/80G/2018-19/A/10188 and 12AA CIT (EXEMPTION), DELHI/12AA/2018-19/A/10215 certificates under Income Tax Act 1961.